Yesterday's TREND = Bearish Down Trend

Yesterday's Power On Close = Strength

Today's Open = GAP Up 9.5 pts

Result = Tight Range Bullish Drifter

Today's TREND = Tight Range Bullish Drifter early, Then Midday Sell Off.

Today's 15 Minute Close Bar =Dn@ 1335.00

Today's Power On Close = Weakness

Daily Volume = 2.67M High Volume

Today's $TICK close = DN@ +179

Daily Market Bias For Tomorrow =

- 0.786 Moderate Bear

- 0.786 Moderate Bear

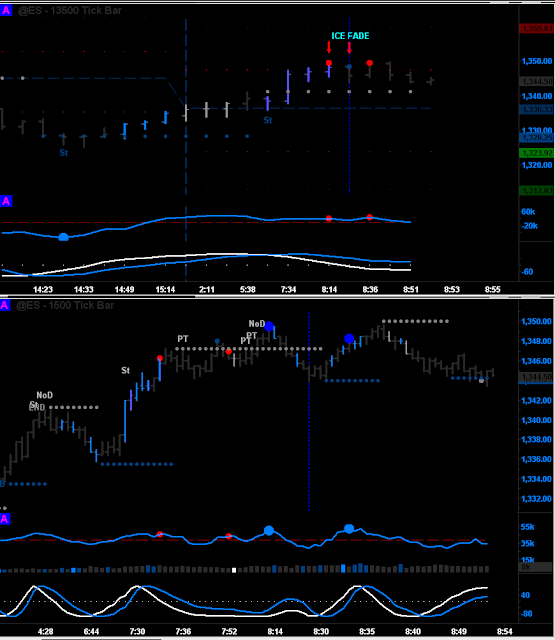

Today was a Gap Up above 8 (9.5pt) that ranged very tight and slowly drifted higher. This came after a high volume Down bars on the @ES Daily and a Probar Doji on the @ES.D. Then price sold off hard at the 1351 top at 8:30 peak down to 1339. Next week im expection some topping prior to a down trend continuation.

TRADE OF THE DAY

Not much to speak of with such a very tight range and minimum opportunities all morning, There was an off sync bottom put in as a test of the Gap area, from here we got slow motion drift upwards. The 7 bar did give a clue as the nature of the day. Signaling a continution of up trend with reversal key/hook bar pattern for 7:45-8:00 on very low volume.

INTANGIBLE OBSERVATION:

Try to Enter On Up Bars when Shorting

and Down Bars when Buying, Remember VSA logic and

Focus on higher time frames when entering and managing your trade, this will help with staying for max profit

On the Ice Breaker:

***-look to Fade the Hi and Lows instead of breakouts. WHEN the Pre-Open has High Volume at tops/bottoms that NEED TO BE TESTED before continuing. The 2 minute shows a closer look at the volume activity at this time also.

13,500 and 1500 look at an Ice Fade.

-Also when the Market Bias calls for a Strong Range like today, Look to fade the Hi/Lo's or Stay out if their are NO signs of momentum or tight consolidation is on the pre-open.

Strategies for Large Gaps 8+ in direction of 15 minute Close Bar.

A slow range drifter after a high volitility day. (see more)

Once the potential is Identified for a trend drifter day by meeting the criteria of:

-Gap up in same direction as 15 minute close.

-Gap more than 8+ pts

-Slow Open and soft test of Gap area/15 minute Open bar low.

Market bias Calls for Range day (extra)

If you choose to trade on these days use can choose to use tight target or ATM Orders to protect small gains. Or Hold till close. Trend days has a 80% chance of closing on the highs of the day. If we get a great early entry, then trailing for the day may be a good option.

WHAT THEY LOOK LIKE:

On Extra Large Gap Days (around 8+ point). Look for Tighter Trading ranges, some tend to drift away from the gap area for the day.

HOW TO TRADE IT

Ideally we want to look for a test of the gap area and fade the lows,

look for 7 bar clue as to trend continuation potential.

As the move progresses...

Look at the $TICK to determine Trend and range potential and adjust targets accordingly. The $TICK trend line will stay above the 0 line in an uptrend.