Yesterday's TREND = Tight rang Up early to midday sell off and Accumulation on close

Yesterday's Power On Close = Strength

Today's Open = Open @ 1269.00 GAP DN (.5pt)

Result = Conitnuation of Accumulation pattern at the close

Today's TREND = UP till 7 bar/ Horizontal Range

Today's 15 Minute Close Bar =DN@ 1263.75

Today's Power On Close = Strength

Daily Volume = 3.25M Ultra High Volume

Today's $TICK close = -39

Daily Market Bias For Tomorrow =

.875 Moderate Bull

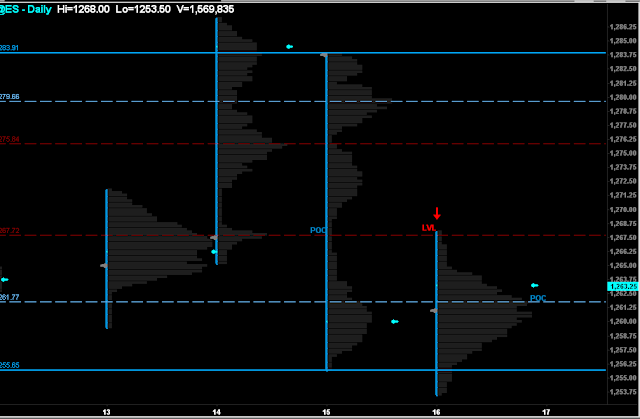

As expected we Got an early bounce into a solid trend day. Professional used the News to spike prices down to catch stops and trap amatures, before moving up. We open with No gap but had a FAT Profile of the Globex session and prior days close.

Today we closed UP as a Horizontal Range day. A Doji Type absorption pattern on Ultra high Volume. This marks the 3rd High volume day on the Daily in a row suggesting that professional are stepping in accumulating at wholsale. A break above 1270 could see a friday rally back to the 1280 level, conversly a rejection at this level could lead prices back to new lows. I'll be looking for early price rejections at support.

Today we closed UP as a Horizontal Range day. A Doji Type absorption pattern on Ultra high Volume. This marks the 3rd High volume day on the Daily in a row suggesting that professional are stepping in accumulating at wholsale. A break above 1270 could see a friday rally back to the 1280 level, conversly a rejection at this level could lead prices back to new lows. I'll be looking for early price rejections at support.

TRADE OF THE DAY

Came very early as price showed strong signs of accumulation leading into yesterdays close and my market Bias was Bullish.

I was looking for the first price rejection at any Support. The 1500 and 500 tick sync to provide the support with a pro bar on the 500 and a PT close on the 5, along with BB 1/2 line bounce and bullish divergence.

a good 1 shot 1 kill entry was 1259.75 long targeting the POC upper range of 1267-1269.

This shows the 1st TOD that came early.

POC Inevitable Target (Notice the Fat Profile from the Globex session) A sign of a power move to come.WHAT I DID WELL:

This was my best day yet. I got 1 shot 1 kill early.

Things were very clear, i could recognize Profit Taking by Dark pools on the 15 minute chart. Inevitable target on the VP and Higher Time frames. my Entry's were perfect and my Exits even better. I recognized the Time and was out when the news hit avoiding whipsaw and was able to spot the strength very well.

INTANGIBLE OBSERVATIONS:

Trust the POC inevitable targets.

When we get a Fat Daily profile (globex & .D) trust bounces off the POC. Early price rejection of these areas may the start of a trend or rally.

Consider reentries at prices that previously work well. Price tends to trade to and back thru these areas hitting the same targets from the past. (ESPECIALLY ON OBVIOUS TRENDS)

Be aware of the actual time as it relates to the 15 minute Bars. Price will react at the open & close of each bar, often times as seen in the forex price will stall prior to advancing or declining to its intended direction (it may test a poc level etc) early in the 15 minute bar only to close at the Hi/Low of the bar at eh close. People Buy and Sell at the OPEN and CLOSE of popular time frames (ie. the 15 and 5 minute bars) In other words, you can look to fade the close of a 15 minute bar by observing the volume prior to and at the close of the bar.

I prefer the 15 minute bar prior to the 7bar peaks.